Classic Cars Are Officially The Second-Best Investment You Can Make

If you're looking to invest in the next big thing, forget watches, wine, and art - it seems classic cars are the new alternative asset you should be looking at.

It seems that traditional investment companies are also capitalizing on the trend, with Italy's Azimut asset management firm launching a find that invests in classic cars, reports Reuters. The fund won't be made up of regular classics but rather vehicles that have a unique history and are worth more than €1 million (approximately $1.1 million) each.

"We've been monitoring the market for a long time," explained Giorgio Medda, CEO of Azimut. "The track record of the past 30 years tells us classic cars have become a financial asset class we want our clients to have in their portfolios."

Alberto Schon, the head of Ferrari and Maserati dealer Rossocorsa, will advise the fund on what to pick.

The Azimut classic car fund won't have an end date and can receive new investments constantly. It's not a new idea, though. In 2021, Switzerland-based Hetica Capital introduced a €50 million "closed fund," which was reportedly the first of its kind. Hetica has purchased several cars so far and is hoping to expand the collection to 30-35 cars by its fifth year.

That leaves just two years to sell the vehicles and pay investors back, with Hetica aiming for returns of 9-15% after seven years. If you're interested in putting some money into these funds, you'd better have deep pockets. Both funds have a minimum investment requirement of €125,000 (roughly $137,000) - about the same price as a brand-new BMW M8 Coupe.

"We get loads of calls from people who're looking to invest €1,000-€2,000, and we have to turn them down," explained Hetica's Walter Panzeri.

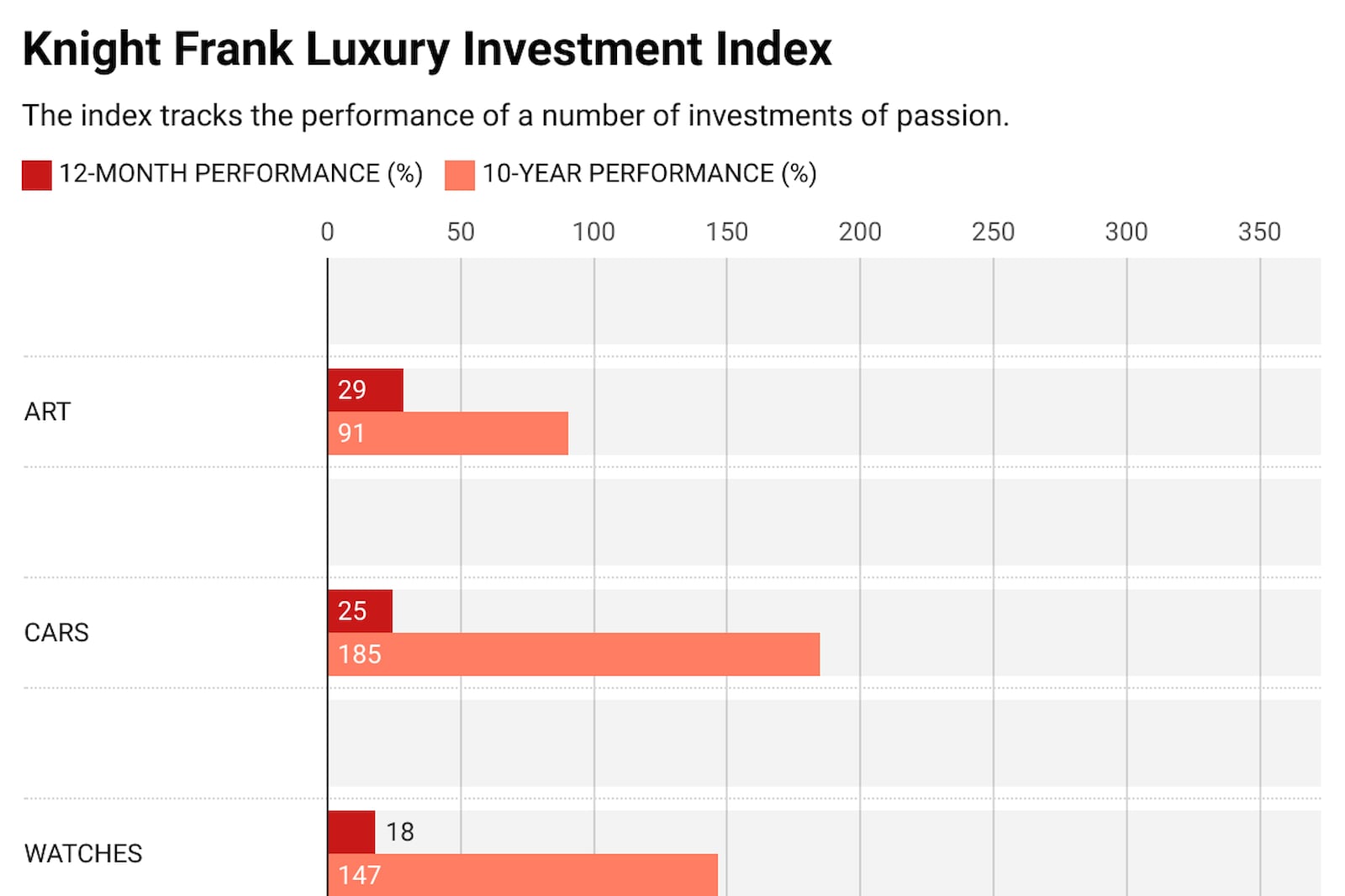

Citing Knight Frank's 2023 wealth report, the value of vintage cars has increased by 185% over the last decade, outpacing art, wine, and other big-ticket items. The only niche that beat out classic cars was rare whiskies.

The downside to these classics is running costs. Unlike more conventional investments, classic vehicles require constant upkeep and maintenance, and replacing parts can be incredibly costly. A new bumper can be as much as $15,000. According to Florian Zimmermann, another collector, the costs associated with these vehicles can eat into 5-6% of the portfolio's value annually.

"It's getting harder and harder to find the proper mechanics to keep these cars alive. And you have to spend quite an amount of money to keep all these cars in running condition," added Zimmermann.

But, he says, that hasn't quelled demand: "Once, it was only people who knew the cars inside out. But over time, others simply thought: I like these cars, I can afford one, and I don't lose money by buying it."

You only need to look at some recent auction prices to see the money a rare classic car can attract. Five years ago, a 1962 Ferrari 250 GTO sold for a record amount of $48,405,000. Just a few months ago, someone paid $148 million for a Mercedes-Benz 300 SLR 'Uhlenhaut Coupe,' one of two ever made.

Of course, these investment funds need to ensure they're buying bona fide classics and not just replicas made to look like the real deal. Certifying the authenticity of these vehicles can cost more than $20,000, but it's essential to prove the vehicle's provenance.

Interestingly, this trend will only grow, with classic car values expect to skyrocket in the coming years. And what's driving all of this? Electric vehicles. "Electrification will favor classic cars," said Maserati Classiche's Cristiano Bolzoni. "Over time, they will become cult objects." So, if you're thinking about buying that dream classic, maybe it's time to pull the trigger before it is too late.

Verwandte Nachrichten